Investors reflecting on the outlook for equities in 2024 must first consider the events of the previous year. The equity market saw a steady rise throughout 2023, but 2024 is expected to present more challenges, including increased volatility and periods of uncertainty. However, five key reasons suggest that 2024 could still be a promising year for equity investors.

Increase in Retail Fund Flows: Following the low point of the bear market in October 2022, it took about a year for retail investors to shift from selling to buying. This change occurred in November 2023, with an increase in long-term flows into mutual funds and ETFs. This trend of moving from money market funds to riskier assets, including equities, is likely to continue.

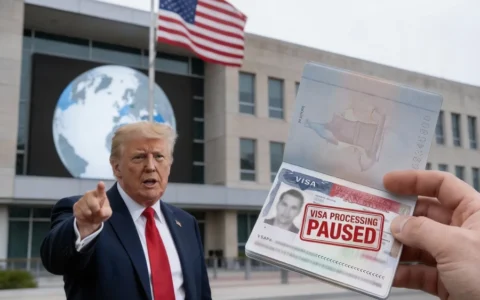

Presidential Election Impact: Historically, U.S. stock markets have gained in years when a president runs for reelection, regardless of the election outcome. Since 1944, the average one-year return for U.S. equities in such years is 16%. With the fiscal spending under acts like the Infrastructure Investment and Jobs Act, the CHIPS Act, and the Inflation Reduction Act, the economy might remain stronger than anticipated.

End of Fed Rate Hikes: The period after the end of the Federal Reserve’s rate hikes is typically favorable for stocks. Although rate cuts are not expected soon, there’s potential for market advancement. The Fed’s primary focus was on combating inflation, not slowing the economic cycle. Therefore, rate cuts, when they happen, will likely signal a victory over inflation rather than economic distress.

Cooling Inflation Numbers: Improvements in inflation figures allow the Fed to adopt a less hawkish stance, benefiting the market. As inflation numbers continue to improve, at least in comparison to previous highs, this could positively influence the market for some time.

Positive Market Breadth: Towards the end of Q4 2023, 90% of stocks in the S&P 1500 index were above their 50-day moving average, indicating a bullish market breadth. This trend is a strong signal that the market could perform well in the coming months.

Key Investment Themes for 2024:

Value and Growth Stocks: Post-recession periods often see a strong performance from value stocks, which are generally more economically sensitive. The muted value recovery post-COVID and expected fiscal spending in 2024 could boost sectors like financials and industrials. However, investors should not overlook growth stocks, particularly in consumer discretionary and technology sectors.

Defensive Sectors: Defensive sectors like consumer staples, healthcare, and utilities, traditionally favored during bear markets, may underperform in 2024, as was the case in 2023.

U.S. and Global Stocks: Investors have often erred in recent years by allocating too much to international stocks at the expense of U.S. equities, based on the perception of better value. However, U.S. stocks, especially those in the NASDAQ, have seen more positive earnings revisions compared to other regions. Therefore, a balanced strategy that includes both U.S. and international stocks may continue to outperform in 2024.

In summary, while 2024 may not be as straightforward as the previous year for equity investors, there are significant reasons to remain optimistic. By carefully considering these factors and themes, investors can navigate the potential volatility and capitalize on the opportunities that the year may present.