To most people around the world, the notion of uprooting one’s life and moving to a foreign country is a scary thought. But that hasn’t stopped the millions of Americans who’ve expatriated from their home country and sought a better life abroad.

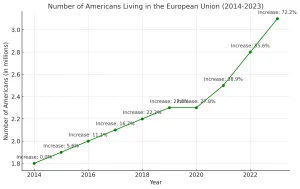

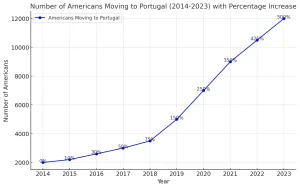

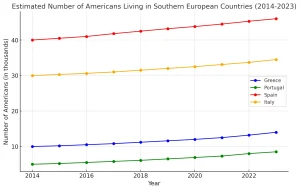

Millions of American citizens have chosen and will choose to leave their native country in search of new opportunities, better quality of life, a better tax environment, and financial advantages abroad. Since 2014, the number of Americans living in the European Union alone has surged by 72%, with a staggering 500% increase in Portugal alone.

The American expatriation wave isn’t just a fad. The data has given boom to the investment migration industry and prompted professionals to ask:

Why are so many Americans living abroad? And where are they choosing to settle?

This comprehensive analysis explores the reasons behind this mass migration, the jurisdictions courting American expats with open arms, and the steps involved in making such a significant life change.

By understanding these factors, you, too, can make an informed decision backed by data and professional insights of the American expat experience.

Why Are Americans Leaving?

Of course, an American citizen will choose to leave their native country for many potential reasons. It could be a combination of the following or none of the below factors at all.

Regardless, each situation is deeply personal and demands respect as such.

1. Cost of Living and Inflation

Rising Expenses in the United States

While offering some of the greatest economic and business opportunities in the world, the United States has experienced a steady increase in the cost of living over the past decade.

America’s large cities – New York City, Los Angeles, San Francisco, Washington DC, and Miami – have seen a marked increase in cost of living since 2018. Miami alone has experienced a 26% increase in living costs in that time (Numbeo).

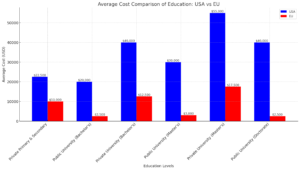

Almost all aspects of daily life, including healthcare, education, and commodities, have reached mind-numbing prices. Coupled with student loan and credit debt, housing prices have skyrocketed, with median home prices reaching over $1 million in some areas.

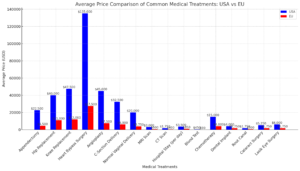

The average American spends thousands of dollars annually on health insurance premiums and out-of-pocket medical costs, which can be significantly lower in other countries with more affordable healthcare options or even universal healthcare systems.

Such a fast increase in cost of living has been prohibitive for many Americans trying to get ahead.

The financial strain caused by stagnant wages and increasing cost of goods and inflation has forced many Americans to allocate a huge portion of their income to basic necessities. Then, they have little room to save or spend in the economy.

Seeking Better Work-Life Balance

Another common cause for Americans seeking a life abroad is a more relaxed approach to work.

According to the OECD, Americans work the ninth most hours in the world and far longer hours compared to workers in almost all European countries. The pursuit of the “American Dream” can often come at the expense of personal well-being and family time.

Especially in cities like New York City and San Francisco, the American work culture encourages long hours and constant availability, leading to burnout and decreased job satisfaction.

In comparison, if you’ve ever ventured to the Nordic countries or Southern Europe where they prioritize work-life balance, you’ve witnessed how relaxed and nonchalant their work culture is. Employees enjoy generous vacation time, shorter workweeks, and a focus on productivity over hours spent in the office. This cultural shift allows Europeans to spend more time on personal interests and family, which can contribute to an overall better quality of life.

Of course, each culture has pros and cons. A heavier societal emphasis on work-life balance can disincentivize economic growth, which is evidenced by Europe’s increasing irrelevance on the global geopolitical stage.

It’s more so about finding what environment and ideals best work for you, considering your phase of life and goals.

2. Political and Social Climate

It’s no secret Americans are at each others’ throats, especially in the period leading up to an election. And technology has not helped the issue at all. Political polarization and social tension have led some Americans to consider emigration to more stable social environments.

Other countries suffer from similar problems as well. America is not unique in that aspect. But having traveled all over the world, Americans tend to be far more polarized than other societies.

Many American expats leave their home country in search of a political climate more aligned with their personal beliefs, whether they’re concerned about LGBTQ+ rights, gun violence, or abortion rights.

Safety Concerns

Personal and familial safety has become a growing concern for many American expats – and a common reason for their expatriation.

The United States has experienced an increase in crime rates, along with mass shootings and civil unrest. According to the FBI’s Uniform Crime Reporting Program, violent crime rates have fluctuated over the last few decades, but high-profile incidents, especially those exacerbated on social media, contribute to a heightened sense of insecurity.

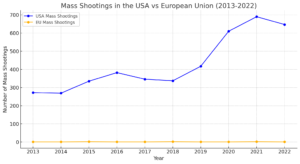

But there’s also data to support the fact that mass shootings in America are increasing in frequency and severity. In each of the last four years, Americans have experienced more than 600 mass shootings – on average, almost two mass shootings a day.

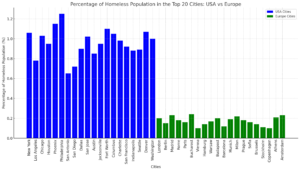

American urban city centers have turned from busy business hubs to drug-infested hellholes, which have severely impacted perceptions of safety. Big cities’ homelessness, inadequate infrastructure, and strained public services have contributed to Americans’ migration to the suburbs – and out of the country.

Trust in American institutions and civic engagement are at an all-time low. This lack of stability does not encourage US citizens to invest in property, start a business, or raise a family.

3. Taxation Issues

Understanding Tax Liability

The United States is the only major country that exercises citizenship-based taxation, meaning American citizens are required to file a tax return, disclose financial accounts, and pay taxes on their worldwide income, regardless of where they reside or spend time in the world.

But even before Americans live abroad, many are dissatisfied with the punitive tax structures and measures already in play. The GILTI tax, which came into effect in 2017, made previously untaxed Controlled Foreign Corporation (CFC) earnings taxable, retroactive for more than 40 years. In California, for example, those in the upper tax brackets effectively pay more than half of their income to their city, state, and federal governments every year. Moreover,

The recent Supreme Court case Moore v. US highlighted another burden of the American tax system. The ruling opened the door to future wealth taxes and other forms of taxation on unrealized and undistributed gains.

Tax Optimization Strategies

Jurisdictions all around the world offer tax benefits to encourage immigration and economic stimulation in their country.

By relocating to a country with a favorable tax regime, American citizens can legally reduce their tax liabilities. Countries like Greece offer a lump-sum tax regime, where foreign wealthy individuals don’t even have to file a tax return. No matter how much income they make that year, they simply pay a flat fee every year to the Greek government.

And, if an American expat is not open to the idea of renouncing their US citizenship, they can optimize their tax situation through careful planning and using provisions such as international double taxation agreements, the Foreign Earned Income Exclusion (FEIE), and the Foreign Tax Credit (FTC).

Since American expats must continue paying US taxes unless they renounce, engaging with a knowledgeable international tax professional is crucial. They may recommend strategies like establishing residency in a country with low or zero tax and/or using trusts and foundations to reduce your tax liability to as low as 0-10% on earnings.

4. Healthcare System

The US healthcare system is characterized by high costs, long waits, and disparities in care. Even with insurance, hospital bills and medications can be substantial. Medical debt is a leading cause of bankruptcy in the United States, and many forgo necessary treatments just due to costs.

Advantages Abroad

Countries with universal healthcare systems can provide excellent healthcare funded by tax residents’ taxation.

American expats who travel indefinitely most often get expat health insurance, and those living abroad in a single location purchase a local insurance plan. Regardless, health insurance abroad can be tailored to individual needs. For families, the availability of quality care and international schools ensures that children’s health and education are well-supported.

In addition, medical tourism has spiked in recent years as Americans seek health care in other countries, where it’s often more affordable, faster, and just as high-quality.

5. Quality of Life Abroad

Global Mobility and Freedom

During the pandemic, migration routes to and from the United States were largely cut off. The American passport was degraded to the travel freedom of the Cambodian travel document, arguably one of the worst passports on the planet.

During this time, mobility became a privilege. And Americans who desire freedom felt stripped of their rights. A single passport became a chokepoint and limitation.

One solution to this issue is holding residency or citizenship in a foreign country. With additional passport or residency permits in your portfolio, an American expat can enjoy more visa-free access, banking access, job opportunities, and investment options in countries around the world. A simple tourist visa cannot offer the same benefits.

Moreover, with the rise of digital nomadism and remote work, many Americans are living abroad for the very first time and realizing that they may be happier, healthier, and wealthier in another country. With just an internet connection in Mexico City (the largest city in North America) or Southeast Asia, skilled workers can build businesses or contribute to fast growing companies from wherever they want.

And in terms of safety abroad, many countries around the world offer American expats more safe environments. The US State Department outlines the best countries for safety in their travel advisories.

This new degree of mobility has opened the eyes of many Americans and been the leading reason for the departure of many American expats.

Cultural Experiences and Natural Beauty

New cultural activities, traditions, great food, and landscapes – Living abroad is immersive.

From national parks within an hour’s drive from San Jose, Costa Rica, to the shopping scene and connected world of any given Central European country, the cultural experiences offered outside one’s home country are enriching. No matter where you live abroad, you’re always within close distance of a new experience.

Despite the common language barrier and challenges of life in a new country, many expats can find solace and build a social network in entrepreneurial groups and community events (like expat meet-ups, entrepreneurship communities, coworking centers, language courses, and more). Contrary to popular belief, there are plenty of ways to meet new people in another country.

Where Are American Expats Going?

Each American expat has a different experience abroad. Formed by their goals, financial situation, phase of life, and personality, the best countries for life abroad differ on several dimensions.

Some retire abroad to a safe, tranquil beach town in Southern Europe. Others prefer access to high-powered, bustling cities via hyper-connected international airports like Seoul, South Korea, or Hong Kong for their adventure abroad.

What may not be appealing to many expats may be the best possible option for another.

Nevertheless, Outbound Investment recommends a few jurisdictions for their tax-friendliness, ease of residency and/or citizenship programs, and expansion of travel freedom:

Golden Visas and Residency by Investment

Europe’s appeal lies in its high standard of living and connectivity.

The significant increase in Americans relocating to the European Union since 2014 – as illustrated above – reflects the continent’s appeal. With robust economies, excellent infrastructure, and lower cost of living, European countries can offer a compelling package for the right American expats.

Portugal

With a 500% increase in the American expat population in the last decade, Portugal has emerged as a top destination for American expats. Why?

Their Golden Visa program allows non-EU citizens to obtain residency through a €250,000 (roughly $275,750 as of the writing of this article) investment. Benefits include the right to live and work in Portugal, access to the Schengen Area, and a pathway to a EU permanent resident permit or citizenship after five years.

With cool cafes, a booming food and wine scene, and a thriving arts culture, Portugal’s cities like Lisbon, Algarve, and Porto have witnessed the majority of this immigration influx. Plus, English is widely spoken, which eases the transition for an American living in Europe.

The cost of living in Portugal is lower than in many US cities, with affordable healthcare and education. The country’s natural beauty adds another layer to the quality of life there. Additionally, if time zones are a concern for the American entrepreneurs and businesspeople, Portugal is just five hours ahead of New York – far more preferable for most than the 12-hour difference in Singapore or Hong Kong.

While its popular Non-Habitual Tax Regime was cancelled, it may stage a comeback and offer advantageous tax incentives again.

Spain

Spain, too, offers a golden visa program where for €500,000, Americans investors can purchase real estate and obtain temporary residency in the European Union. The likely reason for Spain being the main draw of American expats is its appealing program for Latin American immigrants, who qualify for citizenship after just two years of residency.

Cities like Barcelona and Madrid offer cosmopolitan experiences, while coastal towns offer a more relaxed, Mediterranean vibe.

Greece

For those seeking an even slower lifestyle in the midst of ancient history and gorgeous island landscapes, the Greek Golden Visa program provides residency through real estate investment as well. However, citizenship in the country requires tax residency and seven years of continuous residence before qualification.

In all three countries above, international schools, co-working spaces, and networking events are plentiful. Availability of the quality education and modern, first-world amenities you’ve come to expect in the United States ensures a smooth integration.

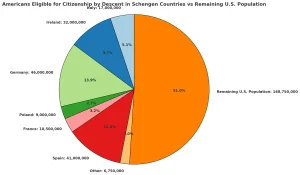

Citizenship by Descent

If you desire citizenship quickly and easily, citizenship by descent is your best bet. This method is the lowest cost and most straightforward with a bit of lineage homework.

And good news – Many European Union countries offer programs for which you may qualify without stepping foot in the country. Here’s how it works:

Eligibility and Process

Citizenship by descent allows individuals to acquire citizenship based on their ancestry. If you can prove lineage to a parent, grandparent, or even great-grandparent from countries like Ireland, Italy, and Germany, you may qualify for citizenship in the country as well.

In most countries, the process simply involves gathering documentation (like birth and marriage certificates, immigration records, etc.) that proves the family connection. Legal assistance may be necessary to navigate the requirements.

The first step is organizing your family tree and examining whether you’re eligible for citizenship by descent in the countries from where your ancestors come.

Benefits

Obtaining citizenship through descent provides the right to live, work, and study in the country indefinitely. If that country is also part of a settlement bloc like the European Union, citizenship may also give the individual residency, labor, education, and healthcare rights and social benefits in all the bloc’s member states (27 countries in the case of the European Union).

Additionally, citizenship by descent allows individuals to reconnect with their heritage and explore their cultural roots.

Nearly half of American citizens qualify for citizenship by descent in Europe. And as the fastest, easiest way to qualify for European citizenship, an American expat with the proper documentation should take advantage.

Citizenship by Investment

In most cases, residency by investment grants investors temporary residency. On the other hand, citizenship by investment programs offer direct citizenship for those willing to make a financial commitment to a country’s economy. Options include:

- Real Estate Investment — Purchasing local property above a certain value threshold.

- Business Investment — Incorporating or investing in a local business that creates local jobs.

- Government Bonds — Investing in government securities for a specified period.

- Donation — Contributing to a national development fund or public project.

In Europe, Malta offers a citizenship by investment program. But more popular programs exist all over the world, including five countries in the Caribbean, Turkey, and Vanuatu, a Pacific island nation.

Advantages

These programs provide expedited pathways to citizenship, often within months. Benefits include:

- Tax Incentives — Favorable tax regimes, including exemptions or reductions.

- Global Mobility — Enhanced travel freedom with powerful passports, especially in the case of renunciation of American citizenship.

- Security — A safe haven for assets and family in times of geopolitical unrest.

- Business Opportunities — Access to new markets and economic environments.

However, these programs require careful due diligence to ensure compliance with international regulations and, of course, alignment with personal goals. Make sure you speak with impartial, unbiased immigration service providers, not those who stand to benefit from your investment in one jurisdiction over another.

Even so, citizenship by investment is for those looking for quicker access to another country and more visa-free travel. One doesn’t necessarily need a second citizenship if permanent resident status may suffice.

How Can Americans Expatriate?

Flag Theory is a risk minimization model where individuals diversify their life across different countries – not just their financial assets – to maximize freedom and minimize vulnerability. Each “flag” may include citizenship, residency, business incorporation, banking, assets, and digital presence.

By spreading these elements globally, individuals can take advantage of favorable laws, protect their privacy, and reduce their risk.

Multiple Income Streams

The rise of self-employment and the digital economy has countless career opportunities. Remote work has enabled professionals to work remotely from anywhere in the world and earn the same revenues and developed-world currencies they’re accustomed to earning.

Business ventures that operate entirely on the internet have ushered in the proliferation of digital nomad visas since 2020, which cater to freelancers, online entrepreneurs, and remote employees who wish to reside temporarily in a foreign country while maintaining their employment elsewhere.

Countries like Portugal, Italy, Costa Rica, and Antigua & Barbuda offer such visas with varying income, health coverage, and documentation requirements.

Typically, we recommend American expats build multiple income streams to minimize risk and guarantee their financial solvency in case of geopolitical risk.

International Banking

Another way to diversify globally is opening foreign bank accounts. As we saw in Canada in 2020, the government can choose to freeze your financial assets and even close your bank accounts if you participate in activities they deem “irresponsible” – even if they’re not illegal.

Managing finances across borders requires establishing banking relationships in multiple countries. Multiple bank accounts help facilitate international transactions, currency exchanges, and access to local financial services.

Diversifying assets internationally can protect wealth from economic, geopolitical, and currency fluctuations and provide access to investment opportunities not available in the U.S. This strategy may include holding multiple currencies, investing in foreign markets, and using international trusts.

American expats should understand the complexities and unique reporting requirements under laws like the Foreign Account Tax Compliance Act (FATCA), which mandates American citizens report foreign financial assets to the Internal Revenue Service (IRS).

Seek professional guidance to ensure compliance with international laws and to structure your portfolio effectively.

Multiple Residencies and Citizenships

By investing time or money in building a portfolio of residency permits and citizenships, one can access all the benefits of a truly diversified portfolio.

- Tax Optimization — Leveraging different tax jurisdictions to reduce tax liabilities.

- Travel Freedom — More mobility and visa-free travel around the world.

- Legal Protection — Utilizing jurisdictions with strong asset protection laws.

- Personal Freedom — Avoiding overreach by any single government.

- Access to Opportunities — Capitalizing on emerging markets and global business opportunities.

Common Considerations

Residency vs. Tax Residency

- Residency — The legal right to remain in a country beyond the time period a basic tourist visa offers.

- Tax Residency — Determines where an individual is obligated to file taxes, based on criteria like physical presence or significant economic ties.

Countries use various tests to determine tax residency:

- 183-Day Rule — If an individual spends more than 183 days in a country, they may be considered a tax resident and may have to file taxes.

- Center of Vital Interests — Factors like family ties, property ownership, business activities, among other considerations.

US Tax Law

The U.S. uses citizenship-based taxation, meaning citizens are taxed on worldwide income regardless of residency. But many of the best countries for American expats have double tax agreements with the United States State Department and IRS, which prevent double taxation of the same income or revenue in multiple jurisdictions.

So, while American expats may establish tax residency in another jurisdiction and have to file taxes, they may not have to pay taxes in that jurisdiction. Mind this careful distinction.

Remember – No matter where they live, American citizens must continue to file US tax returns. And there are severe consequences for not reporting foreign bank account balances, transactions, and income.

However, tax credits and exclusions like the FEIE allows qualifying individuals to reduce their taxable income and maximize their exclusions.

Quality of Life

Every individual’s circumstances and goals are unique. Your approach to life abroad will differ greatly from your fellow expats. Factors to consider include:

- Family Needs — Education for children and healthcare for family members (e.g. nearby clinic and schools)

- Career Objectives — Opportunities for advancement and industry presence (e.g. working or retiring abroad)

- Cultural Fit — Language, customs, and social norms (e.g. sharia law or secular society)

- Climate Preferences — Weather conditions and environmental factors (e.g. number of days of sunshine)

- Connectivity — Distance to relatives and business associates (e.g. two international airports)

A personalized approach ensures your chosen path aligns with you and your family’s aspirations and needs and reduces culture shock.

Professional Guidance

Legal, financial, and logistical aspects of moving abroad are complex. Professionals can assist with:

- Immigration Law — Navigating visa and residency applications

- Tax Planning — Structuring finances to comply with multiple jurisdictions

- Real Estate Transactions — Purchasing property abroad

- Business Incorporation — Setting up companies of a resident alien in foreign countries

First, work with lawyers and accountants in your own country who specialize in cross-border issues. Then, find licensed professionals in your destination country who specialize in serving foreigners who are coming into that country.

Investing in quality advice from various experts (yes, pay for multiple opinions) can prevent costly mistakes. A more informed approach helps you avoid the pitfalls.

Why Is All of This Important?

Holding multiple residencies or citizenships increases your freedom to travel, live, and work internationally. And, strategic planning of those jurisdictions can lead to significant tax savings, asset growth, and wealth diversification.

These mobility and financial benefits protect your wealth and your family in times of economic and geopolitical instability.

Apart from these more tangible benefits, American citizens have access to a better quality of life, more affordable health care, top-tier education, and safety in other parts of the world. More access to the world means more business and investment opportunities.

Less reliance on a single government’s policies empower individuals to make choices more aligned with their values and goals.

Global Citizen Week: International Planning Summit in Miami

Moving abroad isn’t an easy task alone. It requires careful planning and expert guidance.

In Miami from October 30 to November 2, Outbound Investment has gathered the world’s leading immigration service providers, tax advisors, and fiduciary and corporate service providers to help you move and live abroad seamlessly.

Connect with fellow expats; discuss your options with immigration, law, and tax specialists from around the world; and participate in interactive workshops to receive answers to all your curiosities about internationalizing.

How to Register

Spaces are limited to maintain an intimate, exclusive environment. Secure your spot by visiting our website or contacting our team directly.

The growing trend of Americans moving abroad is a phenomenon that should not be ignored. The benefits (e.g. lower cost of living, improved personal safety, more investment opportunities, increased diversification, less risk, etc) are boundless. And with access to the resources and professionals that will make it happen, your good life is just a few steps away.

The best countries in the world await you.