Since the launch of Saudi Vision 2030 in 2016, Saudi Arabia has emerged as a global investment hub, fostering strong economic ties with foreign investors such as China. This strategic relationship offers Chinese investors unparalleled opportunities in a rapidly diversifying Saudi market. In order to position itself as a business-friendly destination for international stakeholders, Saudi Arabia has allowed for 100% foreign ownership for the first time. This article explores the required licenses that Chinese investors should obtain to capitalise on the Saudi market effectively.

Saudi Market Overview

Saudi Arabia has seen significant growth in Foreign Direct Investment (FDI) since 2021, consistently exceeding annual targets. In 2023, FDI inflows reached SAR 96 billion, contributing 2.4% to the country’s GDP. Key contributors to FDI include G20 nations such as France, the United Kingdom, and the United States.

In Addition to the strategic partnership with China, with over 750 Chinese companies operating in the Kingdom. Significant Chinese investments have been made in key sectors such as manufacturing, financial and insurance, construction, wholesale and retail trade, infrastructure and energy. As Saudi Arabia continues to diversify its economy and attract foreign investment, it offers promising opportunities for Chinese businesses. This diversification demonstrates the country’s potential for sustainable economic growth.

The Type of MISA Licenses for Foreign Fully Owned Companies

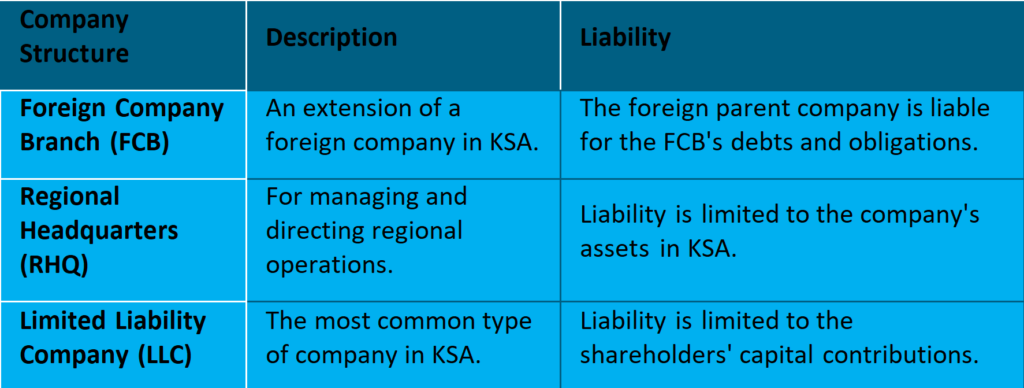

For Chinese investors seeking 100% foreign ownership, they can establish one of the following company structures:

Business/Service Based License

Besides the MISA license, companies maybe required to obtain another license based on their business activities the different types of required licenses available and their specific requirements. Here’s a breakdown to guide you:

⦁ Service license

⦁ Commercial license

⦁ Industrial license

⦁ Real estate license

⦁ Temporary license

⦁ Agricultural license

⦁ Economic liaison license

⦁ Professional license

⦁ Scientific and technical office license

Investor Premium Residency Another Way for 100% foreign-Ownership in KSA

The Premium Residency ‘Iqma’ Programme in Saudi Arabia is a residency permit scheme designed to attract investors and entrepreneurs to the Kingdom. It offers several benefits, including the ability to own businesses and properties with 100% ownership, as well as the ability to sponsor the entry of family members into the Kingdom. The eligibility for the program is restricted to Investors, entrepreneurs and real estate investors.

There are various tracks which can be used to obtain one’s Premium Investor Residency. Most popular tracks include:

1. Temporary Residency Track– This track offers premium residency which needs to be renewed yearly. The only requirement for this track is proof of the applicant’s financial capability. The fees for this track are SAR 100,000 per year, with a reduction of 2% per annum on an accumulative basis.

2. Permanent Residency Track– This track offers permanent lifetime residency upon completion of a one-time payment of SAR 800,000.

3. Investor Track– Under the investor track, there are two classes of investors:

The first is a real estate investor, where the investor owns developed residential real estate assets worth a minimum of SAR 4,000,000 within KSA. There must be no loans or mortgages against the property, and the residency lasts as long as the property is retained.

The second class is the business investor track, where the investor invests SAR 7,000,000 as their share of the investment while holding a valid investment license and commercial registration. This class of investors obtain lifetime residency in KSA.

Navigating the Saudi market needs full understanding, especially for businesses unfamiliar with its unique dynamics. This is where TASC Outsourcing steps in. With deep expertise in market entry strategies, compliance, and workforce solutions, TASC empowers Chinese investors to establish and grow their presence in Saudi Arabia.