Over the past decade, direct investment between China and Germany has experienced significant transformations, with the investment environment growing increasingly complex. This complexity has led to a decrease in two-way foreign direct investment (FDI) figures in the first three quarters of 2023, contrasting sharply with the positive trends of 2022.

Despite this overall downturn, sectors like automotive and advanced manufacturing continue to draw German companies to China, as evidenced by high levels of reinvested earnings, indicating a deepening commitment in the Chinese market. On the German side, the potential for electric vehicle (EV) sales is a beacon of hope amidst generally low investment levels from Chinese companies.

The article delves into the latest data on direct investment between these two countries, exploring the economic and political factors influencing recent trends.

German Investment in China: A Mixed Picture

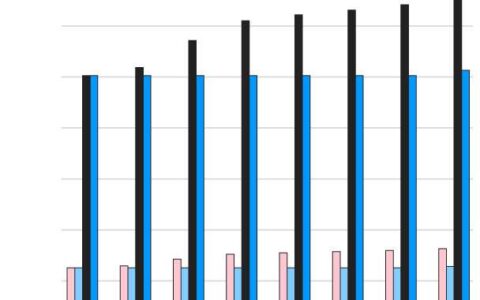

Data from Deutsche Bundesbank shows a 30 percent decline in Germany’s FDI outflows to China in the first three quarters of 2023, down to EUR 7.98 billion. This marks a significant shift from the record EUR 11.4 billion in 2022. However, the actual use of foreign capital from Germany to China, as reported by China’s Ministry of Commerce (MOFCOM), increased by 21 percent in the same period.

The discrepancy in data arises from the different methodologies used by Deutsche Bundesbank and MOFCOM in calculating FDI. While the former includes a broader range of transactions, the latter focuses on contracted foreign capital that has been paid.

Despite the overall decline, German direct investment in China remains substantial, with reinvested earnings exceeding overall FDI inflows. This trend suggests a concentration of investment among a few large established German companies, such as Volkswagen, BMW, Daimler, and BASF.

Factors Influencing German Investment Decline

Several factors have contributed to the decline in German FDI into China. The overall reduction in FDI inflows into China and outflows from Germany in 2023 is a primary factor. Economic challenges in Germany, including a recession and the energy price crisis, have led to a general scaling down of investments abroad. The decrease in investment guarantees provided by the German government to companies investing in China is another contributing factor.

Despite these challenges, the share of German FDI in China rose from 11.6 percent in 2022 to 16.4 percent in the first half of 2023. German companies continue to express strong commitment to the Chinese market, citing competitiveness and China’s innovation potential as key drivers.

Automotive Sector: A Focal Point for German Investment

The automotive sector, particularly the EV industry, remains a significant area of investment for German companies in China. Major German automakers are forging partnerships and joint ventures to strengthen their presence in the Chinese EV market. Notable initiatives include BMW’s investment in NEUE KLASSE EV models and Volkswagen’s partnership with XPENG and Audi’s collaboration with SAIC Motor.

Advanced Manufacturing: German Investment Continues

Germany’s advanced manufacturing sector is also expanding its presence in China, attracted by market potential, innovation opportunities, and lower operational costs. Key investments include Siemens’ expansion of its digital factory in Chengdu and Henkel’s new smart factory in Shandong province.

Chinese Investment in Germany: A Decline

Chinese investment in Germany has seen a drastic decline in the first three quarters of 2023, with a 233 percent decrease year-on-year. Increased scrutiny over Chinese investment deals in Europe, especially in sensitive industries like semiconductors, has contributed to this trend. However, Chinese companies continue to focus on Europe for EV battery production, with significant investments in battery manufacturing in Germany.

China’s Efforts to Attract FDI Amid EU’s De-risking Strategy

The Chinese government is actively seeking to attract foreign capital to combat the low FDI recorded in 2023. Measures include guidelines to improve the foreign investment environment and efforts to attract investments in strategic and high-growth sectors. However, Germany and the EU are simultaneously pursuing strategies to reduce reliance on China, particularly in critical materials and commodities, which may impact mutual investment.

The Road Ahead: Consolidation and Strategic Investment

Looking forward, mutual investment between China and Germany in 2024 is likely to be characterized by consolidation among large companies and continued investment in strategic sectors. The tension between collaboration and independence, particularly in the realm of green technology, will be a defining aspect of this investment relationship.