The Rise of the Yuan in Cross-Border Transactions

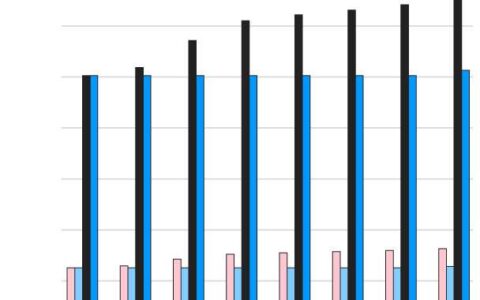

As we delve into the complexities of international trade and cross-border payments, it’s clear that the Chinese yuan is carving out a significant role for itself. Recent data reveals a 24% surge in transactions settled in yuan between China and the global market within the first three quarters of this year. Marking a historical shift, the yuan now represents over half of China’s international transactions, overtaking the U.S. dollar’s long-standing dominance.

China’s Currency Ambitions and Global Alignments

China’s aspirations to elevate the yuan’s international stature are becoming increasingly evident. Yet, the currency’s ascendancy is primarily confined to trades with nations sharing close political ties with China. Countries like Argentina, Nigeria, Russia, and Pakistan, particularly in the wake of the Ukraine war and subsequent sanctions on Russia, are keen to diminish their dollar dependency. However, the yuan’s growth trajectory faces inherent limitations. A substantial portion of China’s trade occurs with U.S.-aligned countries, and surpassing the dollar’s supremacy is a formidable challenge. Presently, the yuan constitutes a mere 3.7% of global payments by value, dwarfed by the dollar’s commanding 46.6% share.

Investor Sentiment and Economic Projections

Investor interest in Chinese assets has experienced a decline over the past year. Mounting tensions with the U.S. and uncertainties regarding China’s long-term economic prospects have contributed to this cautious stance. As China continues to navigate its position on the global stage, the yuan’s future as a dominant currency remains a subject of keen speculation and strategic maneuvering.

The Kiplinger Letter: A Trusted Guide Through Economic Trends

This analysis is part of the ongoing insights provided by The Kiplinger Letter. Since its inception in 1923, The Kiplinger Letter has offered concise weekly forecasts on business, economic trends, and governmental actions. These insights aim to equip subscribers with the foresight needed to optimize their investments and financial decisions. For those navigating the intricate landscape of international trade and currency dynamics, keeping abreast of such forecasts is invaluable.

Conclusion: A Dynamic Future for International Trade

The shifting dynamics of international trade and currency roles underscore a world in economic flux. As the yuan seeks to expand its influence and countries reassess their financial alliances, the future promises a complex interplay of political, economic, and strategic factors. Understanding these trends is crucial for stakeholders aiming to navigate the evolving terrain of global trade and investment.