The global stock of outbound Foreign Direct Investment (FDI) experienced a notable decline in 2022, interrupting a significant expansion trend that spanned over three decades. According to the United Nations Conference on Trade and Development (UNCTAD) figures, the market value of global outward FDI stock fell to $39.8 trillion, down from $42.67 trillion the previous year. This decrease was primarily due to reduced outbound investments from multinationals based in developed countries, though the trend was also influenced by the withdrawal of capital by a telecommunications company in Luxembourg.

Outward FDI stock, which represents the total value of direct investments made overseas by domestic companies at a specific time, serves as a key indicator of a country’s external economic relationships. Traditionally, nations with higher outward FDI stocks are home to major multinational corporations and are deeply integrated into the global economy. This is distinct from outward FDI flows, which measure how actively investors from a country have been investing abroad over a specific period, such as annually or quarterly.

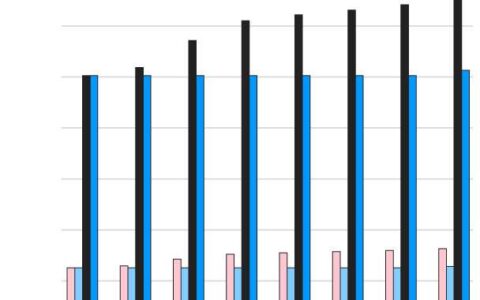

The United States remains the leader in global outward FDI, despite a 17.6% drop in 2022, with its stock totaling more than $8 trillion at year-end. Historically, the U.S. reached a milestone in 1993 when its outbound FDI stock hit $1 trillion, with the UK following suit nine years later. Conversely, the U.S. also tops the charts for inward FDI stock, which tracks investments made by foreign companies within the country. At the end of 2022, global inward FDI stock was valued higher than outward at $44.3 trillion.

Several factors contribute to the differences between inward and outward FDI measures, including variations in country reporting standards, exchange rate fluctuations, and round-tripping—where favorable regulatory regimes are used as intermediaries for FDI flows.

Looking at other nations, the Netherlands holds the second-largest stock of outbound FDI, valued at $3.25 trillion in 2022, which represents a significant growth from $945.5 billion in 2007, despite a 6.4% decrease from the previous year. China ranks third, with an outward FDI stock of $2.93 trillion, marking a 5.2% increase from 2021 and a staggering 343% growth over the decade leading up to 2022.

The UK and Hong Kong also feature prominently in the rankings for outward FDI stock, with the UK at $2.2 trillion and Hong Kong at $2.05 trillion at the end of 2022. Hong Kong’s FDI stock has risen by 65% over the past decade, underscoring its role as a crucial financial hub and a gateway for multinationals conducting business in mainland China.

Other significant players include Canada, with an outward FDI stock exceeding $2 trillion, followed by Japan, Germany, and Luxembourg, with Singapore rounding out the top ten at $1.59 trillion. France, Switzerland, and Ireland also have their outward FDI stocks valued at over $1 trillion, highlighting their active roles in global investment landscapes.

This overview provides a snapshot of shifting global economic dynamics and the changing roles of various countries in the landscape of international investments.