On January 1, a significant shift in international corporate taxation took place as a global minimum corporate tax rate of 15% was implemented in several European and Asian countries. This initiative, led by the OECD and the G20, aims to curb base erosion and profit shifting (BEPS) by multinational corporations, which have historically leveraged global corporate structures and favorable offshore tax regimes to pay minimal taxes. The move is expected to generate billions of dollars annually from profits that were previously taxed at much lower rates.

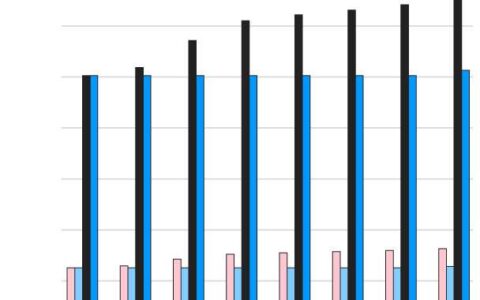

A graphic representation shows the impact on corporate tax in jurisdictions that have adopted or are in the process of adopting these new laws, especially those with average effective tax rates below 15%. The OECD’s research indicates that low-taxed corporate profits are not just a feature of traditionally low-tax jurisdictions but also countries with high overall corporate tax rates due to exceptions for certain large corporations.

Jurisdictions like The Bahamas, Guernsey, Jersey, and the Isle of Man are working on implementing new laws, despite being at early stages. Andorra, a European micro-nation with a statutory corporate tax rate of 10%, has already implemented the new minimum tax. The country’s government noted that it does not host many companies that the law targets, namely those with annual revenues over 750 million Euros.

Interestingly, an OECD paper found that over half of the multinationals’ profits taxed below 15% were in high-tax jurisdictions. The data revealed that of the $5.9 trillion in annual average multinational profits assessed, $750 billion were taxed below 5%, and $1.39 trillion were taxed between 5% and 15%. This initiative has led to increased corporate taxes in countries with low average taxation, such as Bulgaria and Hungary, and tax havens like Cyprus, which is delaying implementation by up to a year.

While Ireland and the UK, which previously levied average effective corporate taxes below 15%, now have new laws in place, 145 jurisdictions have joined the BEPS framework. However, only 102 have signed the related multilateral convention, with several ratifications pending.

Notably, some tax havens with a 0% effective tax rate, like the Cayman Islands, the British Virgin Islands, and the Turks and Caicos Islands, lag in this process. However, countries like Bahrain, Belize, Hong Kong, Monaco, Panama, and the Seychelles have ratified the convention.

The global corporate minimum tax is still a work in progress, with many loopholes to be addressed, but legislation passed or proposed in countries such as Belgium, Barbados, Bermuda, Gibraltar, Luxembourg, the Netherlands, Singapore, and Switzerland sets an optimistic tone for the future of international corporate taxation. This initiative marks a crucial step towards ensuring more equitable taxation of multinational corporations worldwide.