The impending conclusion of Spain’s “golden visa” program is expected to temporarily invigorate the local real estate market, particularly in regions favored by foreign investors. Since its initiation in 2013, the program has successfully attracted billions of dollars from non-EU citizens, offering them residency in exchange for significant real estate investments. The program’s end, announced by Spanish Prime Minister Pedro Sanchez in April, requires an investment of at least €500,000.

This program has contributed significantly to the vitality of Spain’s real estate market, issuing over 10,000 visas, predominantly to Chinese and Russian investors. However, the cessation of this initiative is predicted by real estate professionals like Ariana Meiler Gruber of the New Madrid to create a surge in demand as prospective buyers rush to make investments before the program formally ends.

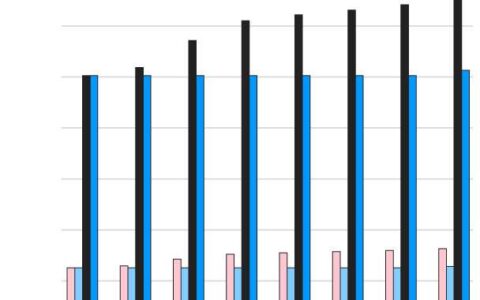

While the program has bolstered Spain’s economic recovery post-Great Recession by attracting external financial injections, it has also faced criticism. Locals argue that the influx of foreign capital has escalated property prices beyond the reach of many Spaniards, exacerbating housing affordability issues. The national price per square meter of new homes has risen by 33.6% over the past decade, intensifying public discontent and pressure on the government to act.

The Spanish government’s decision to phase out the program aligns with broader European concerns about such schemes. Following the European Commission’s 2022 recommendation, prompted by the potential for money laundering and tax evasion, several countries have reevaluated or ended their investment residency programs. Portugal and Ireland have terminated theirs, and Greece has increased its investment threshold.

Despite the program’s impending end, experts like Rod Jamieson of Lucas Fox International Properties note that the overall impact on the market has been minimal, attributing sustained interest to Spain’s appealing lifestyle and cultural offerings rather than the visa scheme alone. However, the anticipation of the program’s closure is expected to drive a short-lived spike in demand, particularly in metropolitan areas like Barcelona, Madrid, and Malaga, which have historically attracted the majority of golden visa investments.

This scenario presents a dual-edged sword: a potential short-term benefit for the real estate market against the backdrop of long-term challenges in balancing foreign investment interests with national housing affordability. The situation continues to evolve as Spain and other European nations navigate the complex interplay of global investment, domestic policy, and public sentiment.